Hong Kong

HSBC and Ripple Labs are developing Hong Kong's CBDC.

Key words

- Wield: to have and use power, authority, influence, etc., especially in a particular way or for a particular purpose

She wields considerable influence in the industry.

- Prone to: likely to suffer from, do, or experience something, typically something regrettable or unwelcome

He is prone to making impulsive decisions.

- Dissent: to publicly disagree with an official opinion, decision, or set of beliefs

Several members of the committee voiced their dissent.

- Redress: to correct something that is unfair or wrong

Efforts are being made to redress the balance of power.

- Burgeoning: growing or developing quickly

The burgeoning tech industry is creating new opportunities.

Read the article to find the answers

- What was the State ideology of the Qing Dynasty?

- What commodity did Britain begin to export to China to redress the trade imbalance?

- What event led to the First Opium War between Britain and China?

- What is the role of HSBC and Ripple Labs in Hong Kong's financial sector today?

Hong Kong

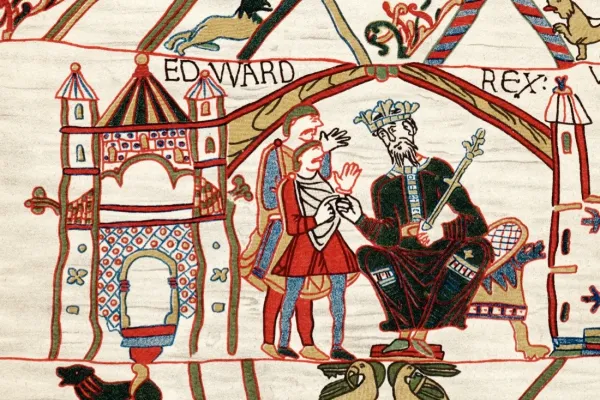

The emperor of the Qing Dynasty, China's last imperial dynasty, was the supreme authority, wielding absolute power through the State ideology of Confucianism, and was often regarded as a divine ruler, the 'Son of Heaven'.

The vast bureaucracy was prone to corruption and inefficiency, which occasionally led to social unrest and local rebellions. Despite efforts to integrate different ethnic groups, there were persistent tensions between the Manchu rulers and ethnic minorities. The Qing rulers sometimes suppressed dissent, often by military force.

The waters around Hong Kong were notorious for piracy and there were minor instances of local unrest around Hong Kong during the Qing Dynasty, but Hong Kong was a relatively small and unimportant part of the Qing Empire. There were only about 7000 indigenous people working as fishermen and farmers, and the government presence was minimal.

The Opium Wars

The Qing dynasty had strict trade regulations, with foreign traders restricted to certain areas and subject to various controls. The British East India Company sought to expand trade opportunities, particularly to redress the trade imbalance caused by the high demand for Chinese goods such as tea, silk and porcelain.

Because China did not want European goods, the main form of payment accepted by Chinese merchants was silver. As a result, vast amounts of silver flowed from Britain to China, creating a significant trade imbalance. The continuous outflow of silver to China created an economic burden on Britain, forcing Britain to find a solution to balance trade and reduce the loss of silver. To address the trade imbalance, Britain began exporting opium grown in British-controlled India to China. Opium became a highly profitable commodity and created a flow of silver from China back to Britain, reversing the trade imbalance.

The Qing government tried to suppress the opium trade, and the First Opium War began after the Chinese authorities seized and destroyed opium stocks in Canton. This led to military retaliation from the British navy who easily defeated the Chinese forces. The war ended with the Treaty of Nanking, and Hong Kong Island was officially handed over to Britain and quickly developed into a major trading port.

Ongoing disputes led to the Second Opium War which resulted in The Convention of Peking that formally expanded the territory of Hong Kong. To ensure the security of the colony, Britain negotiated the lease of the New Territories for 99 years.

The End of British Rule

Under British rule, Hong Kong developed into a major international port and financial centre. Today, under Chinese rule, Hong Kong remains an important financial centre. The Hong Kong and Shanghai Banking Corporation (HSBC) was established in Hong Kong after the end of the Opium Wars to support the burgeoning trade between China and Britain. It moved its headquarters to London in 1993, but maintains a significant presence in Hong Kong.

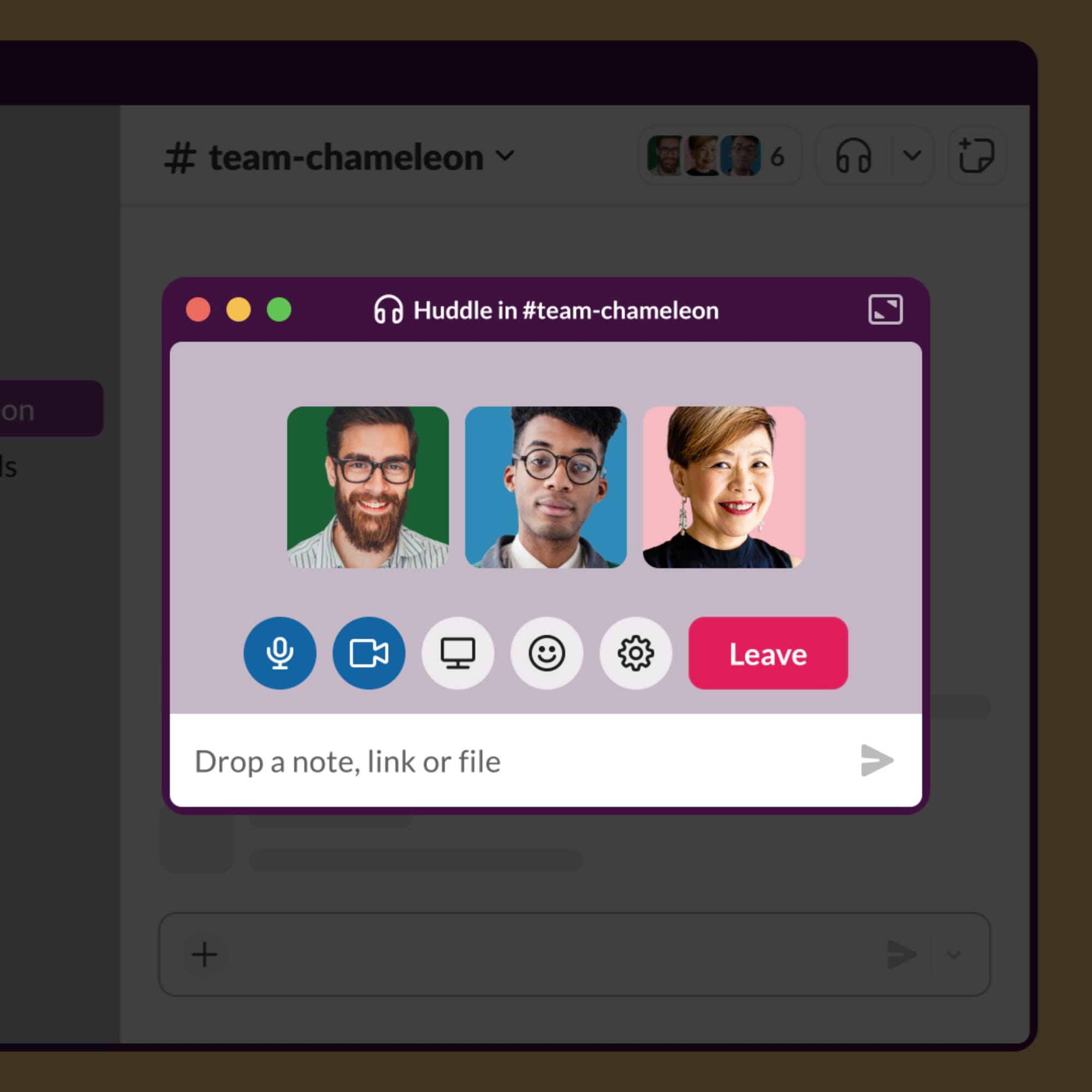

HSBC and fintech company Ripple Labs are actively involved in the development of Hong Kong's Central Bank Digital Currency (CBDC), known as the e-HKD, highlighting the continuing influence of the Anglosphere in China.

Discussion questions

- Do you have any questions about any of the vocabulary or grammar in this article?

- What do you think of the British East India Company's decision to export opium to China to redress the trade imbalance?

- Do you think the British colonisation of Hong Kong was a positive or negative development for the region, and why?

- What role do you think institutions such as HSBC and Ripple Labs should play in shaping the future of Hong Kong's financial sector?

- Do you think the development of a CBDC is a step forward for Hong Kong's economy, or are there potential risks and challenges?