Barclays

Give to everyone what you owe them: If you owe taxes, pay taxes.

Key words

- Quaker: a member of a Christian group, called the Society of Friends, that does not have formal ceremonies or a formal system of beliefs, and is strongly opposed to violence and war

This morning she took me to her Quaker meeting.

- Fiefdom: an area of land, especially one that is rented and paid for by work

The island of Sark was the last fiefdom in Europe.

- Purview: the limit of someone's responsibility, interest, or activity

This case falls outside the purview of this particular court.

- Tax haven: a place where people pay less tax than they would pay if they lived in their own country

The company is switching its operations to the offshore tax haven of the Dutch Antilles.

- Deem: to consider or judge something in a particular way

She is deemed to be the best British athlete.

Read the article to find the answers

- What was Barclays Bank founded as?

- What island did the Barclay brothers buy?

- What has the UK Supreme Court ruled about the Crown Dependencies?

- Where are the roots of offshore banking?

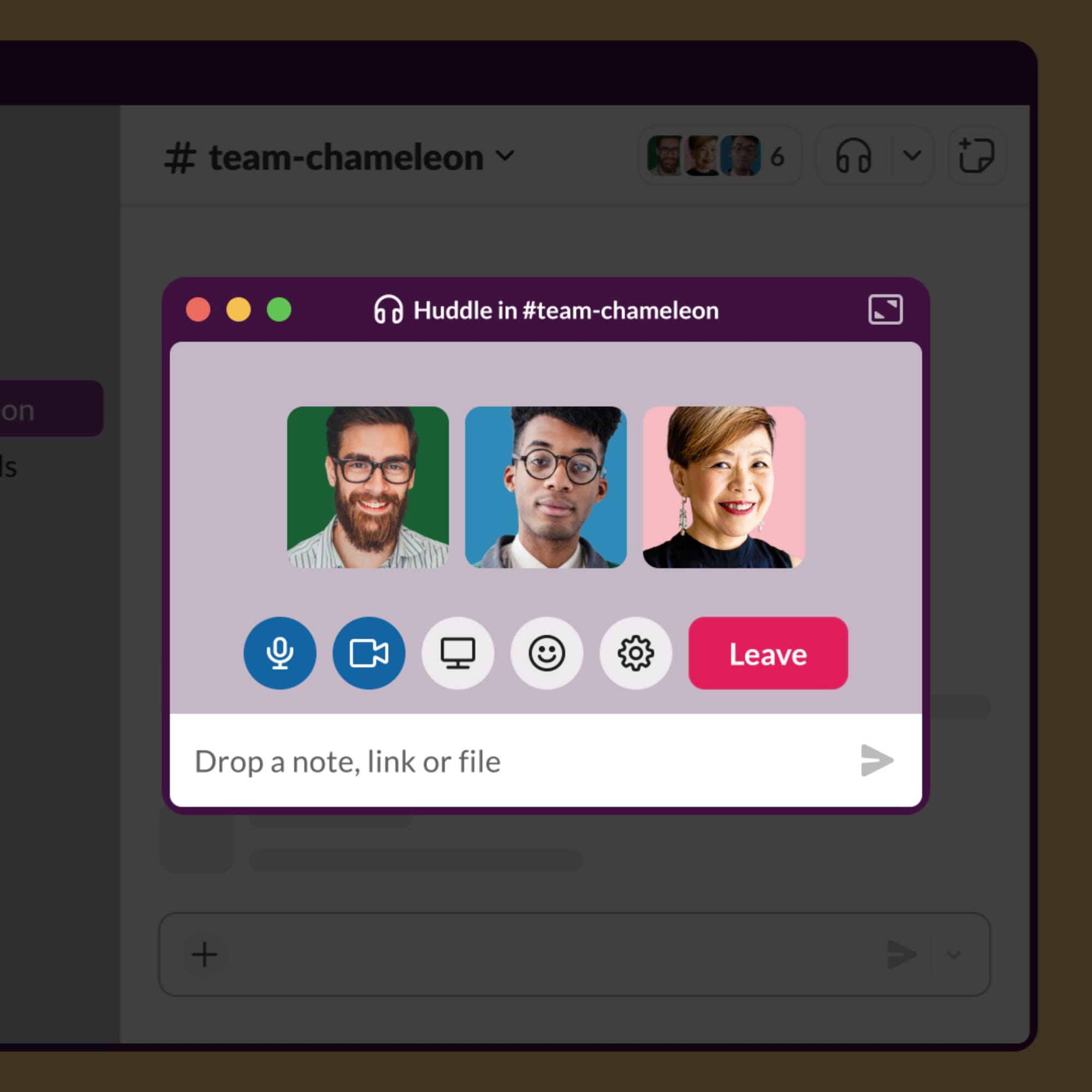

Barclays Bank

The Glorious Revolution established a constitutional monarchy in England, and Parliament affirmed religious tolerance through the Toleration Act of 1689, which allowed non-Anglican groups such as the Quakers to engage in commerce.

Barclays Bank was founded in 1690 as a goldsmith's shop in the City of London by two Quakers. They moved from goldsmithing to banking when they began issuing receipts for deposits, which acted as currency. These receipts were early forms of modern banknotes.

Barclays Bank introduced the world's first automated teller machine (ATM) in 1967 at its Enfield branch in London, a groundbreaking innovation in banking.

The Barclays Brother's Private Island

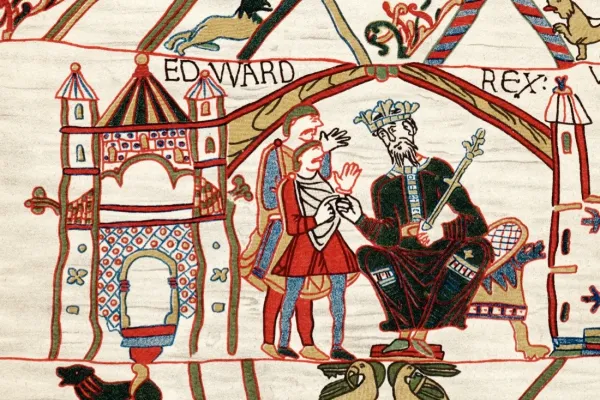

Sark, a small island and Crown Dependency in the English Channel, maintained a feudal system until 2008, making it the last feudal state in Europe. The island's small population of around 500 lived without modern luxuries such as cars. The push for reform came from the new owners of the neighbouring island of Brecqhou.

The Barclay brothers acquired the island of Brecqhou in 1993 as part of a wider strategy to expand their business interests in the Channel Islands, which are often labelled as tax havens due to their low tax rates and financial privacy laws.

The Barclay brothers wanted to make Brecqhou politically independent from Sark, arguing that Brecqhou was not legally part of Sark's fiefdom. The UK Supreme Court ruled against the claim that the UK could intervene in the affairs of the Crown Dependencies, stating that they were outside the purview of UK jurisdiction.

Off-Shore Banking

Offshore banking has its roots in the City of London, where banks enabled corporations to conduct transactions outside the purview of UK jurisdiction.

The Judicial Committee of the Privy Council established that companies using offshore banking services could avoid UK taxes. Corporations conducting transactions that were deemed not to occur within the UK avoided domestic regulatory oversight, and banks in the City of London could lend and borrow US dollars without being subject to US banking regulations or taxes.

Some remnants of the British Empire, including various Caribbean islands, became prominent tax havens offering secrecy and minimal taxation, making them attractive to international criminal organisations.

Discussion questions

- Do you have any questions about any of the vocabulary or grammar in this article?

- Do you know any other influential Quakers?

- What's the history of banking in your country?

- What do you know about offshore banking?

- Are there any fiefdoms near where you live?

- What are your views on taxes, tax havens and jurisdiction?

Book a Lesson

Improve your English language communication skills by practicing with a qualified and experienced native speaker.